How Are Mortgage Rates Determined? | Current Mortgage Rates ...

Treasuries are also backed by the “full faith and credit” of the United States, making them the benchmark for many other bonds as well. (Mortgage rates vs. home .

http://www.thetruthaboutmortgage.com/what-causes-mortgage-interest-rates-to-move/

Treasury Market and Mortgage Rates

Yields on 10-year and 30-year Treasury securities are typically used to set long- term mortgage rates. Loans with short initial terms (1-, 3-, and 5- year ARMs, .

http://mortgage-x.com/general/treasury.asp

The State of Debt

What Moves Mortgage Rates? (The Basics)

Mortgages are priced for sale to attract investors who seek fixed income investments. There are many kinds of bonds available, and mortgage rates ( yields) rise .

http://library.hsh.com/articles/more-tools-resources-and-info/mortgage-basics/what-moves-mortgage-rates-the-basics

How Bonds Affect Mortgage Interest Rates

Treasury bonds are much safer, so their rates are lower. As Treasury rates rise, so do mortgage interest rates. Find out exactly how this works, and how it affects .

http://useconomy.about.com/od/bondsfaq/f/Bonds_Mortgages.htm

Mortgage Rates vs. Bond Rates | Home Guides | SF Gate

Mortgage rates, the interest borrowers pay to buy a property, depend on several complex factors. However, they are strongly linked to bond rates. Bonds are .

http://homeguides.sfgate.com/mortgage-rates-vs-bond-rates-2135.html

Price vs yield

Dec 16, 2002 . Understanding bonds: price vs. yield. By Laura . If interest rates decline, the price of an existing bond or bond fund generally will: A. Increase .

http://www.bankrate.com/brm/news/sav/20021216a.asp

The Impact on mortgage rates vs bond rates Rates

30 YR Mortgage Rates vs. 10 YR Bond vs. FFR | Piggington's Econo ...

For those who predict 30 YR mortgage rates by following the 10 YR Bond . 10 year bond and the current 30 year mortgages reflects the added .

http://piggington.com/30_yr_mortgage_rates_vs_10_yr_bond_vs_ffr

UrbanDigs: Bond Yields & Mortgage Rates No Longer Related

Nov 27, 2007 . A: I want to touch on this topic as I have been asked recently why mortgage rates are not falling as much as 10YR Bond yields have? In the past .

http://www.urbandigs.com/2007/11/bond_yields_mortgage_rates_no.html

Mortgage rates hit lows as economic fears hurt bond yields ...

Jun 1, 2011 . Mortgage rates slid this week for a seventh week, reflecting bond investors' . Bonds make regular fixed income payments, and bond investors .

http://www.usatoday.com/money/markets/2011-06-01-bond-yields-fall_n.htm

Bond Prices and Rates

Note: Mortgages are generally packaged and sold as bonds, called mortgage backed securities. So watching bond yields gives a good indication of the direction .

http://www.goodmortgage.com/Learn/Rates/Bond_Prices_And_Yield.html

Mortgage Rates and Treasury Bonds

How are mortgage rates related to the 30-year treasury and 10-year treasury?

http://qna.mortgagenewsdaily.com/questions/mortgage-rates-and-treasury-bonds

Will it happen?

Prime Rate vs. Mortgage Rate - Budgeting Money

This is because both are long-term investments paying a stated interest rate. Mortgage and bond sellers compete for the same buyers, usually pension funds, .

http://budgeting.thenest.com/prime-rate-vs-mortgage-rate-3744.html

Related posts:

- mortgage ratio

- prospect mortgage jeff boogaard

- mortgage rates wisconsin

- wachovia online login student loan

- mortgage rates west lafayette in

U.S. Government Bonds, Treasury & Municipal Bond Yields ...

Get updated data about United States government bonds. Find information on government bonds yield and interest rates in the United States.

http://www.bloomberg.com/markets/rates-bonds/government-bonds/us/

Joshua Dorkin

Joshua Dorkin

{ 6 comments… read them below or mortgage rates will go lower }

How Interest Rates Affect The Housing Market

Apr 16, 2010 . Mortgages come in two primary forms, fixed rate and adjustable rate, . A mortgage-backed security is a bond backed by an underlying pool of .

http://www.investopedia.com/articles/pf/07/mortgage_rate.asp

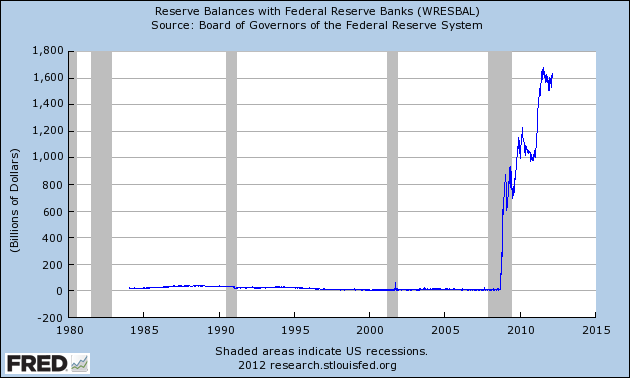

It’s amazing, how much Federal Reserve holds 6x as #2 on the list…

Short-term bond funds vs. CDs | Bankrate.com

Jul 20, 2011 . Certain types of bonds perform better than others in a rising rate environment, including "floating rate bonds that tie into bank loans, TIPS and .

http://www.bankrate.com/financing/cd-rates/short-term-bond-funds-vs-cds/

mortgage rates with bad credit

Which is better, CDs or I bonds? | Bankrate.com

May 2, 2011 . After all, both are backed by the full faith and credit of the U.S. government, and the new I bond rate is 4.6 percent, reflecting a 2.3 percent .

http://www.bankrate.com/financing/cd-rates/which-is-better-cds-or-i-bonds/

US Treasury Yields Definition

Understand the relationship between Treasury bond prices and Treasury yields. Find out how Treasury yields affect mortgage interest rates, and the U.S. .

http://useconomy.about.com/od/economicindicators/p/Treasuries.htm

mortgage rates wells fargo today

Josh,

Realty Times - Bond Yields Push Mortgage Rates Down Slightly ...

Sep 4, 2009 . Real Estate News And Advice - Bond Yields Push Mortgage Rates Down Slightly This Week.

http://realtytimes.com/rtpages/20090904_rates.htm

Bonds, Rates & Credit Markets - Markets Data Center - WSJ.com

Bond Market Charts - Get the latest treasury bond rates and credit rates online from The Wall Street Journal. . Mortgage & Banking Rates .

http://online.wsj.com/mdc/public/page/mdc_bonds.html

mortgage rates where are they going

Agreed.

mortgage ratess

HI

How does the bond market affect mortgage rates? | LoanSafe

Jun 11, 2010 . So theere is no specific “fixed rlationship” between Treasuries bonds of any variety and fixed mortgage interest rates. Given enough data points .

http://www.loansafe.org/how-does-the-bond-market-affect-mortgage-rates

Morrevbon® LLC

These charts shows the spread between mortgage and bond rates as of 10/20/ 2011 based on weekly data from Freddie Mac and The Bond Buyer as shown on .

http://www.morrevbon.com/

Regards

Adam

federal and debt consolidation

Edward Jones: Rates at a Glance

These are exempt from state income tax and are either guaranteed or . Market and interest risk are greater with zero coupon bonds, and interest is taxed in the year . Mortgage-backed Securities .

http://www.edwardjones.com/en_US/market/rates/current_rates/rates.html

printable lowes home improvement coupons

{ 2 trackbacks }