Mortgage Rates and Treasury Bonds

How are mortgage rates related to the 30-year treasury and 10-year treasury? . Yields on the 30-year and 10 year treasury bonds are used to set long-term . like adjustable rate mortgages (ARMs) or hybrid mortgages are usually tied to .

http://qna.mortgagenewsdaily.com/questions/mortgage-rates-and-treasury-bonds

Treasury Market and Mortgage Rates

Mortgage rates generally rise and fall along with yields on Treasury securities. Have a look at today's Treasury market. Treasury yield curve, historical graphs.

http://mortgage-x.com/general/treasury.asp

The State of Debt

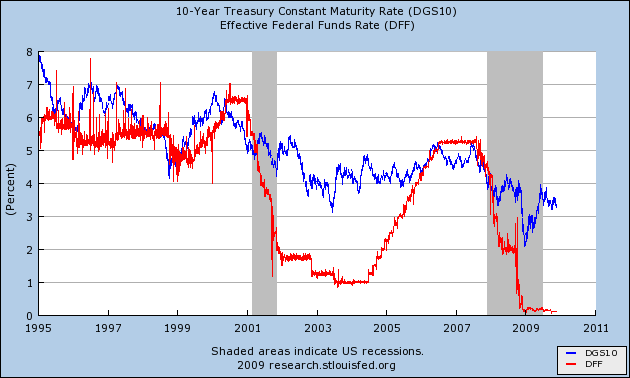

Rate:Yield Curve

U.S. Treasury debt prices rose on Monday, with most gains appearing in the longer maturities on . TIPSTER: Currency Wars and The Yield Curve Lending Trap .

http://www.wikinvest.com/rate/Yield_Curve

How Are Mortgage Rates Tied to Bond Markets? | eHow.com

How Are Mortgage Rates Tied to Bond Markets? thumbnail Mortgage rates are affected by Treasury bond rates. The rates for mortgage loans will usually run in .

http://www.ehow.com/about_7477478_mortgage-rates-tied-bond-markets.html

As treasury yields rise, so do mortgage rates as they reach 4.61 ...

Dec 9, 2010 . As you can also see, this move in mortgage interest rates is tied strongly to the sell-off by investors of treasury bills, which have seen their yields .

http://www.examiner.com/finance-examiner-in-national/as-treasury-yields-rise-so-do-mortgage-rates-as-they-reach-4-61

Relationship Between Treasury Notes Mortgage Rates

While the mortgage market isn't tied to the Fed's rate, there is a relationship . When the yield of the 10-year treasury note drops, the mortgage rate will drop and .

http://mortgage.lovetoknow.com/Relationship_Between_Treasury_Notes_Mortgage_Rates

The Impact on mortgage rates tied to treasury yields Rates

1 year Treasury Bond Bill Yield Notes Average Index Rate One

Apr 25, 2012 . Yields on Treasury securities at constant maturity are determined by the U.S. . of variable-rate loans, particularly adjustable-rate mortgages (ARMs). . When this index goes up, interest rates on any loans tied to it also go up.

http://www.bankrate.com/rates/interest-rates/1-year-treasury-rate.aspx

1 Year CMT | Constant Maturity

8 hours ago . Yields on Treasury securities at constant maturity are determined by the U.S. . of variable-rate loans, particularly adjustable-rate mortgages (ARMs). . When this index goes up, interest rates on any loans tied to it also go up.

http://www.bankrate.com/rates/interest-rates/1-year-cmt.aspx

How Interest Rates Affect The Housing Market

Apr 16, 2010 . Mortgages come in two primary forms, fixed rate and adjustable rate, with some hybrid . interest rates, such as the yield of the U.S. Treasury 10-year bond. . The interest rate on an adjustable-rate mortgage is tied to an index.

http://www.investopedia.com/articles/pf/07/mortgage_rate.asp

What Are Mortgage Interest Rates Tied To?

Mortgage rates are linked to many variables, especially long-term inflation . than usual, the increase in treasury note yield would push mortgage rates up to stay .

http://www.soyouwanna.com/mortgage-interest-rates-tied-to-8578.html

Will it happen?

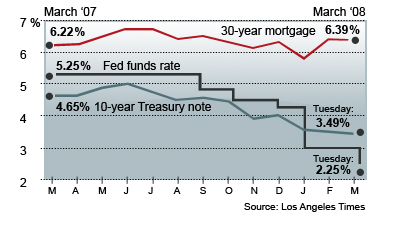

Rising 10-year Treasury note tied to mortgage rates - The Denver Post

Jun 8, 2007 . The yield on the Treasury s 10-year note passed 5 percent Thursday, . Mortgage rates are rising because they're tied to the 10- year yield.

http://www.denverpost.com/business/ci_6087759

Related posts:

- assworship as debt payment

- greg chastain colonial life insurance

- mortgage rates tucson az

- mortgage rates tula jumbo

- mortgage rates us bank

Mortgage Rates Fall, Approach 4% - WSJ.com

Aug 12, 2011 . Mortgage rates are closely tied to the yield on the 10-year Treasury note, which hit a low of 2.14% on Wednesday, before rising to 2.304% by .

http://online.wsj.com/article/SB10001424053111904823804576502583927025242.html

Joshua Dorkin

Joshua Dorkin

{ 6 comments… read them below or mortgage rates to go up }

Credit Spreads Widening / 10YR Treasury Yields / Lending Rates ...

Aug 11, 2011 . Credit Spreads Widening / 10YR Treasury Yields / Lending Rates Rise? . Instead, lending rates will be more closely tied to the evolving credit .

http://www.urbandigs.com/2011/08/chart_of_the_day_10yr_treasury_1.html

It’s amazing, how much Federal Reserve holds 6x as #2 on the list…

Treasury yields pare losses after Fed - Nov. 3, 2010

Nov 3, 2010 . Long-term Treasury yields pared losses Wednesday, after the Fed announced a huge . are to push mortgage rates down and longer-term borrowing rates down, and both rates are closely tied to the 10-year Treasury yield." .

http://money.cnn.com/2010/11/03/markets/bondcenter/treasuries/index.htm

ticket points and auto insurance rates

When will CD rates rise? | Bankrate.com

Feb 25, 2011 . CD rates can be tied to a range of indices or rates. They can be . Banks may also set CD rates based on Treasury security yields. Typically, the .

http://www.bankrate.com/financing/investing/when-will-cd-rates-rise/

1 Year MTA

Apr 25, 2012 . Bankrate.com provides today's current 1 year MTA treasury rate and index rates. . maturity are determined by the U.S. Treasury from the daily yield curve. . cost of variable-rate loans, particularly adjustable-rate mortgages (ARMs). . When this index goes up, interest rates on any loans tied to it also go up.

http://www.bankrate.com/rates/interest-rates/1-year-mta.aspx

credit card machine parts diagram

Josh,

San Francisco Bankruptcy Lawyer: Mortgage Rates Increasing at ...

Feb 16, 2011 . Mortgage rates are tied to Treasury yields, particularly the 10 year Treasury yield. The Treasury yield has been slowly increasing, so it's no .

http://www.westcoastbk.com/blog/2011/02/san-francisco-bankruptcy-lawyer-mortgage-rates-increasing/

Mortgage Indexes Explained - LIBOR, T-Bill, CMT, MTA, Prime, COFI ...

The prime rate is the rate that is tied to home equity loans and many credit cards. . An index of the average yields on US Treasury securities adjusted to a .

http://www.rjbaxter.com/mortgageindexesexplained.html

mortgage rates trends future

Agreed.

mortgage rates tulsa oklahoma

HI

Mortgage-X ~ Everything There Is To Know About Mortgage Loans

Our Mortgage Rate Trend Survey summarizes where mortgage professionals think . ARM rates tied to a lagging index rise more slowly than rates in general. . Mortgage rates generally rise and fall along with yields on Treasury securities, .

http://mortgage-x.com/

Adjustable Rate Mortgages: Your Rate is Tied to an Index: Mortgage ...

Adjustable Rate Mortgages: Your Rate is Tied to an Index . The one-year bill has a yield very near that offered by the 30-year Treasury bond, which is used to .

http://loan.yahoo.com/m/basics3.html

Regards

Adam

mortgage rates utah

Treasury Bonds - Treasury Bills - Treasury Notes - BestCashCow

Feb 17, 2012 . The Best Savings Rates, CD Rates, Mortgage Rates, and more from . on a yield basis, and Treasury notes (2 year, 5 year, 10 year and 30 year) which . are US Treasury instruments with the same perfect credit that are tied to .

http://www.bestcashcow.com/bonds/treasury

health insurance reform guide

{ 2 trackbacks }